11 Steps for Building an Emergency Fund for Families: A Comprehensive Guide

03rd Aug 2023 5 mins read

11 Steps for Building an Emergency Fund for Families_ A Comprehensive Guide_1691060632.jpg)

Current uncertain economic times threaten the stability of Irish families. Now more than ever, it has become prudent for families to set up an emergency fund. Here are the 7 steps you need to create an effective emergency fund.

1. Determine the Size of Your Emergency Fund

Determine the monthly living expenses of your family. Begin by carefully analysing your monthly expenses, including fixed costs like rent/mortgage, utilities, groceries, insurance, and discretionary spending. Factor in any irregular or seasonal expenses such as holiday gifts or annual fees. Once you have an approximation of your family’s monthly expenses, you can determine the size your emergency fund will have to be. Aim for at least three to six months' worth of living expenses. For added financial security, save up to nine months to a year's worth of living expenses. By having a specific goal, it can make saving for an emergency fund seem achievable and it will allow you to track your progress easier.

2. Start Small, Start Now

It's essential to begin saving for your emergency fund, even if you can only afford to start small. The key is to make saving a regular habit, no matter the amount. Don't feel discouraged if you can't save as much as you'd like initially. What matters most is consistency in your savings efforts.

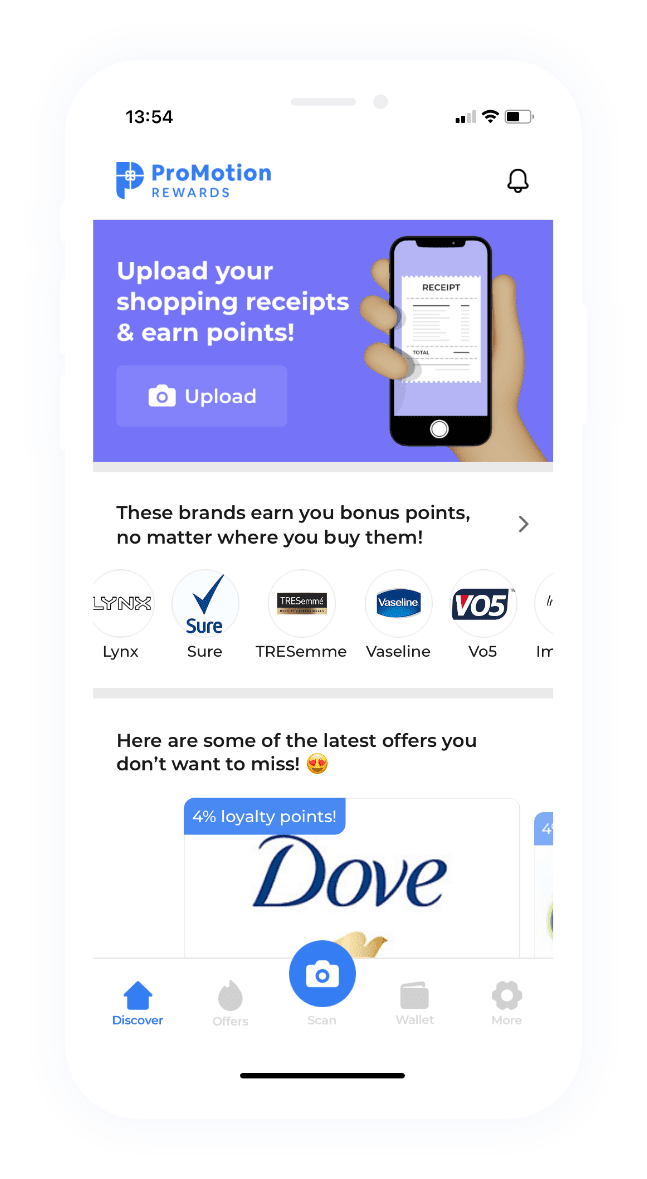

Our favourite saving technique is ProMotion Rewards. ProMotion Rewards is an app that gives you gift cards for your retail or restaurant receipts. Simply scan your receipts with the mobile app, and receive points which you can cash out for Visa cards or gift cards. This is an excellent way to save money, which can later be contributed into your emergency fund.

3. Automate Your Savings

Set up automatic transfers from your checking account to a dedicated savings account specifically designated for emergencies. Many banks offer this service, making it convenient and hassle-free. If your employer provides the option for automatic payroll deductions, take advantage of this to contribute directly to your emergency fund. By automating your savings, you remove the temptation to spend the money elsewhere and make saving a priority.

4. Make Windfalls Count

Unexpected windfalls, such as tax refunds, bonuses, or monetary gifts, provide an excellent opportunity to boost your emergency fund. While it can be tempting to splurge on treats or luxuries, consider diverting a portion of these windfalls into your savings. Prioritising your family's long-term financial security over short-term indulgences will pay off in the long run.

5. Minimise Debt and Interest Payments

High-interest debt can quickly drain your finances and hinder your ability to build an emergency fund. To maximise your savings potential, prioritise paying off debts with high-interest rates, such as credit cards and personal loans. As you reduce debt, you'll not only save money on interest payments but also free up more funds to contribute to your emergency fund.

6. Reevaluate and Replenish

Life circumstances change, and so do your family's financial needs. Regularly reevaluate your emergency fund target and adjust it according to any significant changes in your financial situation. If you need to use your emergency fund for unexpected expenses, make replenishing it a top priority.

7. Consider a Tiered Approach

Once you've achieved your initial emergency fund goal, consider adopting a tiered approach to your savings strategy. Start with a basic fund covering three months' worth of expenses. Then, build additional tiers for larger financial shocks, such as job loss or death of a partner. By creating multiple layers of financial protection, you ensure greater resilience in the face of different emergencies.

8. Explore High-Yield Savings Accounts

While your emergency fund's primary purpose is to provide quick access to cash, it doesn't mean you can't explore ways to maximise its growth. Look for high-yield savings accounts or money market accounts that offer competitive interest rates. While the returns might not be substantial, every bit of interest earned will contribute to your fund's growth over time.

9. Diversify Your Emergency Fund

Consider diversifying your emergency fund by including low-risk investments, such as short-term bonds or certificates of deposit (CDs). While the bulk of your fund should remain easily accessible and liquid, some portion can be allocated to low-risk investments that offer slightly higher returns. However, be careful. Emergency funds are often needed due to poor economic conditions. A struggling economy will make certain investments–like stocks or real estate–lose value. It’s best to keep the bulk of your savings liquid.

10. Protect Your Family with Insurance

While an emergency fund provides a financial safety net, it's essential to complement it with adequate insurance coverage. Review your insurance policies regularly to ensure they sufficiently protect your family against various risks, such as life, disability, and home insurance. The right insurance coverage can act as an additional safety net, reducing the need to dip into your emergency fund for emergency expenses.

11. Avoid Temptation

Strictly reserve your emergency fund for genuine emergencies. Clearly define what constitutes an emergency to prevent impulsive spending. Be disciplined in using the fund only for situations that threaten your family's financial security or well-being.

Building a robust emergency fund is a powerful tool that can safeguard your family's financial stability and provide peace of mind during uncertain times. Remember that financial preparedness is an ongoing process, so stay disciplined and committed to growing and maintaining your emergency fund. For more financial and savings tips, check out our other blog posts.

Have a look at some of our other posts.

ProMotion Intelligence has gotten the attention of the National Press recently, when it ...

FEB 24, 2022 3 MINS READ

Here are out top 5 secret tips to save you some cash while you're out grocery shopping...

MAR 16, 2023 5 MINS READ

High costs of living in Ireland have been causing everyone to re-evaluate their finances...

AUG 03, 2023 3 MINS READ