The Ultimate Budgeting Guide: 10 Steps You Need to Create Your Own Budget

03rd Aug 2023 3 mins read

The Ultimate Budgeting Guide_ 10 Steps You Need to Create Your Own Budget_1691062742.jpg)

Why Should You Have a Budget?

Managing your finances wisely is essential for achieving financial stability and securing a prosperous future. One of the most powerful tools in achieving this goal is creating and maintaining a budget. A budget acts as a roadmap for your money, helping you control spending, save more, and work towards your financial objectives, such as minimising debt or making large purchases like a house or a car. In this blog post, we’ll go over the 10 steps you need to make a budget.

Step 1: Gather Financial Information

To build a budget that accurately reflects your financial situation, start by gathering all your financial information. This includes your income sources, monthly expenses, debt obligations, and any other recurring financial commitments. Use bank statements, bills, pay stubs, and other records to ensure you have a complete picture of your financial standing.

Step 2: Calculate Your Total Income

Sum up all sources of income you receive regularly, including salary, side hustles, rental income, and investments. This step will give you a clear understanding of the funds available to you each month.

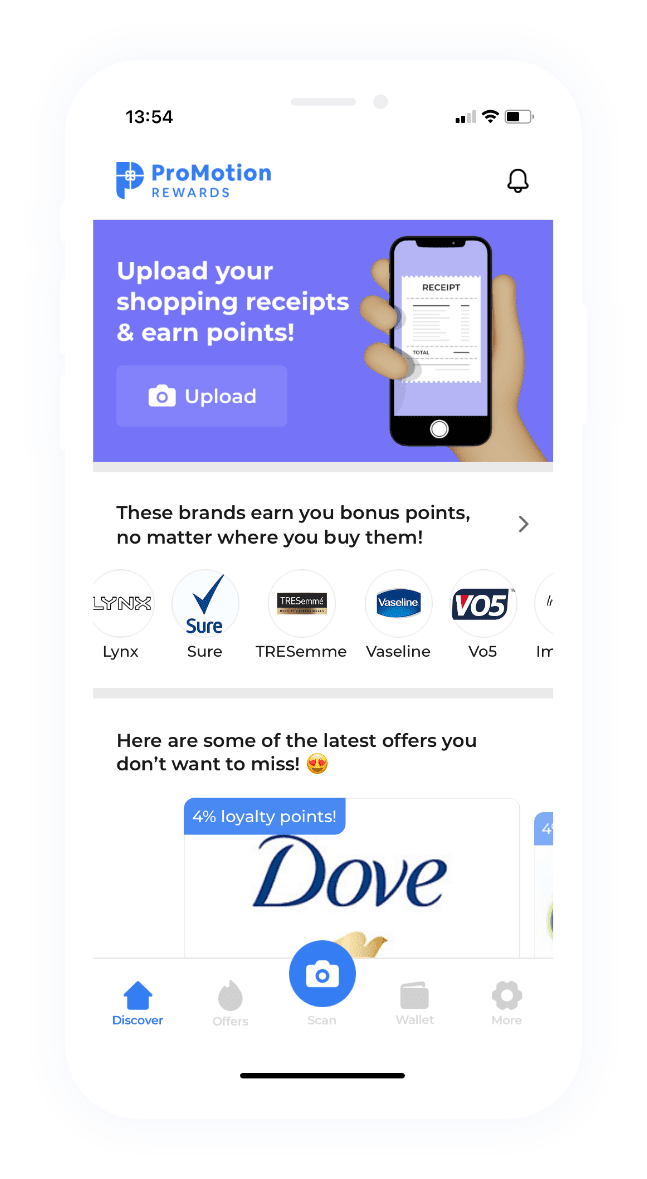

To increase your total income, you should use ProMotion Rewards. ProMotion Rewards is an app that gives you gift cards for pictures of your restaurant and retail receipts. Simply download the app on any smartphone, take pictures of your receipts, and receive gift cards and Visa cards! Download ProMotion Rewards today!

Step 3: List Your Monthly Expenses

Make a comprehensive list of all your monthly expenses, including fixed costs (e.g., rent/mortgage, insurance premiums) and variable expenses (e.g., groceries, entertainment). Don't forget to include occasional or annual expenses by breaking them down into their monthly equivalents.

Step 4: Differentiate Between Needs and Wants

Categorise your expenses into "needs" and "wants." Needs are essential expenses like housing, utilities, and groceries, while wants represent discretionary spending on non-essential items like dining out or entertainment. This differentiation will help you prioritise and cut down on non-essential expenses if needed.

Step 5: Set Financial Goals

Define your short-term and long-term financial goals. These could include building an emergency fund, paying off debt, saving for a vacation, or investing in retirement. Setting clear objectives will give your budget a purpose and motivate you to stick to it.

Step 6: Create a Budget Plan

Using the information from Steps 2, 3, and 4, create a budget plan. Allocate your income to cover essential expenses first, and then assign funds to your financial goals and discretionary spending. Ensure that your total expenses do not exceed your income. If they do, revisit your discretionary spending and find areas to reduce.

Step 7: Use a Budgeting Tool or App

Consider using budgeting tools or apps to make the process easier. These tools can help you track your expenses, set spending limits for various categories, and visualise your progress towards financial goals.

Step 8: Monitor and Adjust

A budget is not a one-time thing; it requires continuous monitoring and adjustment. Regularly review your spending, savings, and progress towards goals. If you notice any deviations, identify the reasons behind them and adapt your budget accordingly. Being flexible is essential to accommodate life changes or unexpected events.

Step 9: Build an Emergency Fund

Life is unpredictable, and unexpected expenses can derail your budget. As part of your financial goals, prioritise building an emergency fund equal to at least three to six months' worth of living expenses. This safety net will protect you from financial setbacks and help you stay on track with your budget even during tough times.

Step 10: Seek Professional Advice

If you find budgeting overwhelming or have complex financial situations, don't hesitate to seek advice from a financial advisor. They can offer personalised guidance and strategies to improve your financial management.

Creating and maintaining a budget is a crucial step towards financial freedom and success. By following these 10 steps, you'll gain better control over your money, reduce financial stress, and work towards achieving your financial dreams. Remember, discipline and consistency are key to making a budget work effectively, so stay committed and celebrate your financial victories along the way. Happy budgeting!

Have a look at some of our other posts.

ProMotion Intelligence has gotten the attention of the National Press recently, when it ...

FEB 24, 2022 3 MINS READ

Tired of eating out draining your wallet? This 5 tips will give your bank account a brea...

JUL 11, 2023 2 MINS READ

Birthday parties are an iconic part of childhood, but they can be pricey! We have 5 idea...

AUG 03, 2023 5 MINS READ